STATISTICS ON MOBILE PHONES

There are so many players in the mobile phone industry. But who is leading and who is falling behind. Check out all the stats on mobile phones i.e the smartphones, feature phones, and the tablets.

SMARTPHONES AND FEATURE PHONES

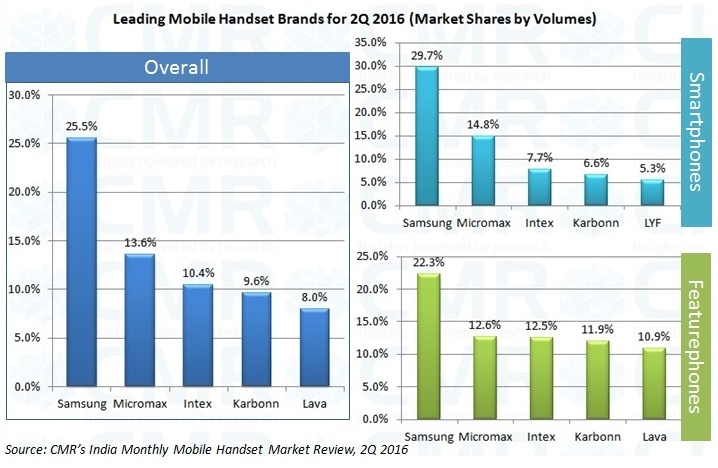

A total of 65.9 million handsets were shipped during the period, of which 56.5% where feature phones, up from 54.9% in the previous quarter.Samsung, Micromax and Intex lead the market in Overall, Feature phones and Smartphones segments. Reliance’s LYF continues to excite the space and holds 5th position within smartphones. The report suggests, smartphones less than Rs 2,000 saw over 200% growth in shipments in 2Q over the previous quarter while strong growth registered in the price bands above Rs 15,000. The high-end smartphone segment, which lies above Rs 20,000 price band, has registered a 35% growth during the quarter, with Oppo, LeEco, Asus, LG and Huawei benefiting the most in this category, added the report.

TABLETS

The Indian tablet market registered a 14.4 percent growth in the second quarter of 2016, recovering somewhat from a sluggish first quarter, an IDC report said. According to the International Data Corporation (IDC), tablet shipments in India (inclusive of slate and detachables) was 0.98 million units in the second quarter. Shipments grew 14.4 percent over previous quarter while dipped 5.6 percent over the same period last year. “Tablet market declined as consumer market receded by 12.5 percent year-on-year in Q2 2016, while commercial segment continues to grow at a healthy rate indicating clear shift in the focus of the market,” said Karthik J, Senior Market Analyst, Client Devices, IDC India.

Approximately three-fourth of tablets sold in India are below $150 and driven primarily by local vendors like Datawind, iBall and Micromax followed by Lenovo. Samsung dominated the mid $150-350 segment while the premium $300 and above segment continues to be dominated by Apple, driven primarily by iPad Air 2. Datawind maintained its top position with 27.5 percent share in the second quarter. Samsung sustained the second position with vendor share of 14.7 percent. “Detachables are seeing better uptake compared to convertibles owing to the reason that convertibles are relatively premium priced while detachables are able to effectively bridge the price and functionality gap between tablets and entry level notebooks,” Karthik noted.

Tablet shipments are expected to grow sequentially as the festive season approaches. “However, overall 2016 tablet shipments are expected to decline marginally this year as ramp of commercial segment is not enough to offset the consumer segment decline,” added Navkendar Singh, Senior Research Manager, Mobile Devices Research, IDC India and South Asia.

New Fund Offering by SBI MF – SBI Dividend Yield Fund

New Fund Offering by SBI MF – SBI Dividend Yield Fund  Bharti Airtel’s 5G user-base expands

Bharti Airtel’s 5G user-base expands  FREE Demat + Trading account opening

FREE Demat + Trading account opening  India’s first Fintech Company listed in the National Stock Exchange and Bombay Stock exchange

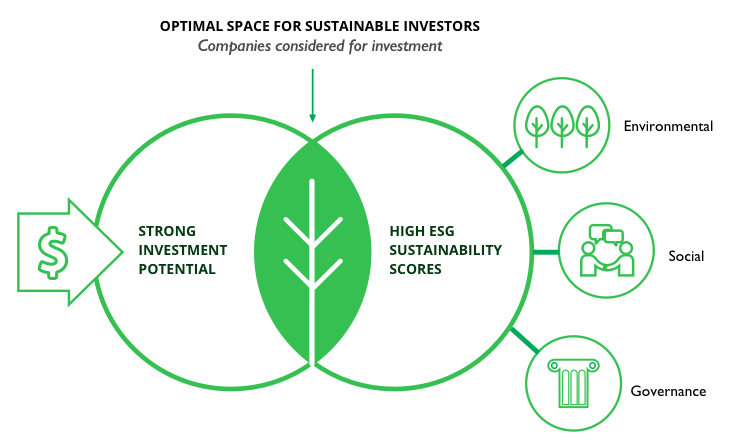

India’s first Fintech Company listed in the National Stock Exchange and Bombay Stock exchange  The Impact Of Air Pollution And ESG Investing.

The Impact Of Air Pollution And ESG Investing.  GK TODAY -HISTORY AT A GLANCE

GK TODAY -HISTORY AT A GLANCE