The Impact Of Air Pollution And ESG Investing.

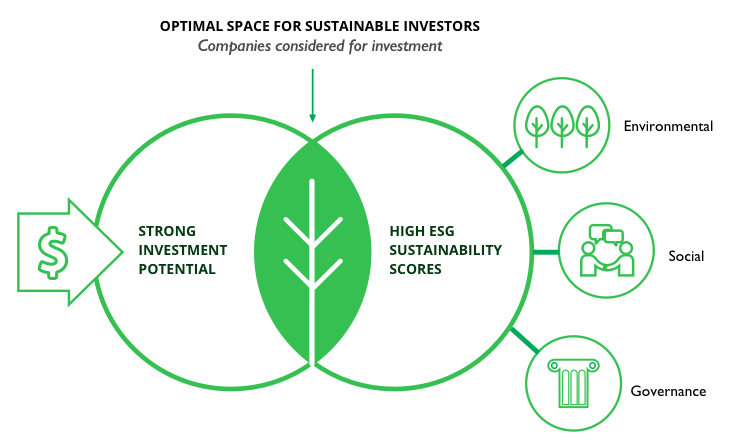

Author: Aditi Murkute Alarming Air pollution reports in Delhi have become a major concern post Diwali. The recent smog developed due to heavy particles settling and burning of farmland to prepare for sowing in the nearby regions is a serious threat to the lives of people. The government-run monitoring agency System of Air Quality and Weather Forecasting and Research (SAFAR) mentioned that, ‘The air quality has deteriorated because of low wind speed, cloudy conditions and an increase in contribution of stubble burning in neighbouring States.’ For the past several years, air pollution in Delhi is the worst of any major city in the world, as per WHO. India has the world’s highest death rate from chronic respiratory diseases and asthma, according to the WHO. In Delhi, poor quality air irreversibly damages the lungs of 2.2 million or 50 percent of all children. Recent cyclonic rains over some parts of western region of the country affected the air quality as well as caused viral infections, bronchitis and other forms of respiratory diseases. How can we try to curb this problem? By consciously taking steps that impact the environment. For instance, not burning of crackers, avoiding the use of plastics, and opting for more environmentally friendly options. Even when we invest our hard-earned money, embracing ‘socially responsible investing’ is essential. Fundamentally, as a part of a larger ecosystem, each one of us has a role to play in the path to progress and sustainable living. We need to be sensitive to Environment, Social, and Governance (ESG) issues–which are crucial subject matters –while looking for wealth-creating investment opportunities. Globally, institutional investors such as pension funds give a lot of importance to ESG parameters when making investments. The ESG theme is picking up in India too with a few mutual fund houses, including Quantum Mutual Fund having introduced Quantum India ESG Equity Fund. The current climate is turning the spotlight on to the ESG theme. This is not just the topic of discussion in the developed economies in Europe and the US, but also perceived to be significant in Asia and emerging market economies. Besides, more and more companies are making a conscious effort and improving their ESG practices. Globally, ESG theme of investment is mature and forms a significant part of investors portfolio, especially in Europe and the US. But recently in India too, due to corporate governance issues, the focus has shifted to adopt ESG investing. You would agree that at a broader level, asset managers have a fiduciary responsibility while serving the interest of investors’ and community/society at large. And what’s reassuring is that in the recent years the availability of alternative ESG information, indicators, and tools have vastly increased enabling asset managers or fund managers to make better investment decisions in the endeavour to responsibly build wealth for investors in the long run. Correspondingly, investors and society at large are turning conscious and socially responsible in their lifestyle choices. Environment, Social and Governance are vital facets of the larger ecosystem we live in. Sensibly handling of the environment and social issues, like global warming, pollution control is essential in the path to progress and sustainable living. Governance also plays a key role, without which everything can fall apart and progress in its true sense may never see the light of the day. For example, a company with lower carbon emission would be a better company than a polluter as it will face lower regulatory or societal risk. So, its shares would be less volatile over time and will provide better returns, if invested in it. for investing open your demat ac today ,sign up here |

New Fund Offering by SBI MF – SBI Dividend Yield Fund

New Fund Offering by SBI MF – SBI Dividend Yield Fund  Bharti Airtel’s 5G user-base expands

Bharti Airtel’s 5G user-base expands  FREE Demat + Trading account opening

FREE Demat + Trading account opening  India’s first Fintech Company listed in the National Stock Exchange and Bombay Stock exchange

India’s first Fintech Company listed in the National Stock Exchange and Bombay Stock exchange  How to Earn more from your Mutual Funds and ETFs

How to Earn more from your Mutual Funds and ETFs  GK TODAY -HISTORY AT A GLANCE

GK TODAY -HISTORY AT A GLANCE