Steps for obtaining GST

2 min read

Steps for obtaining GST

2 min read

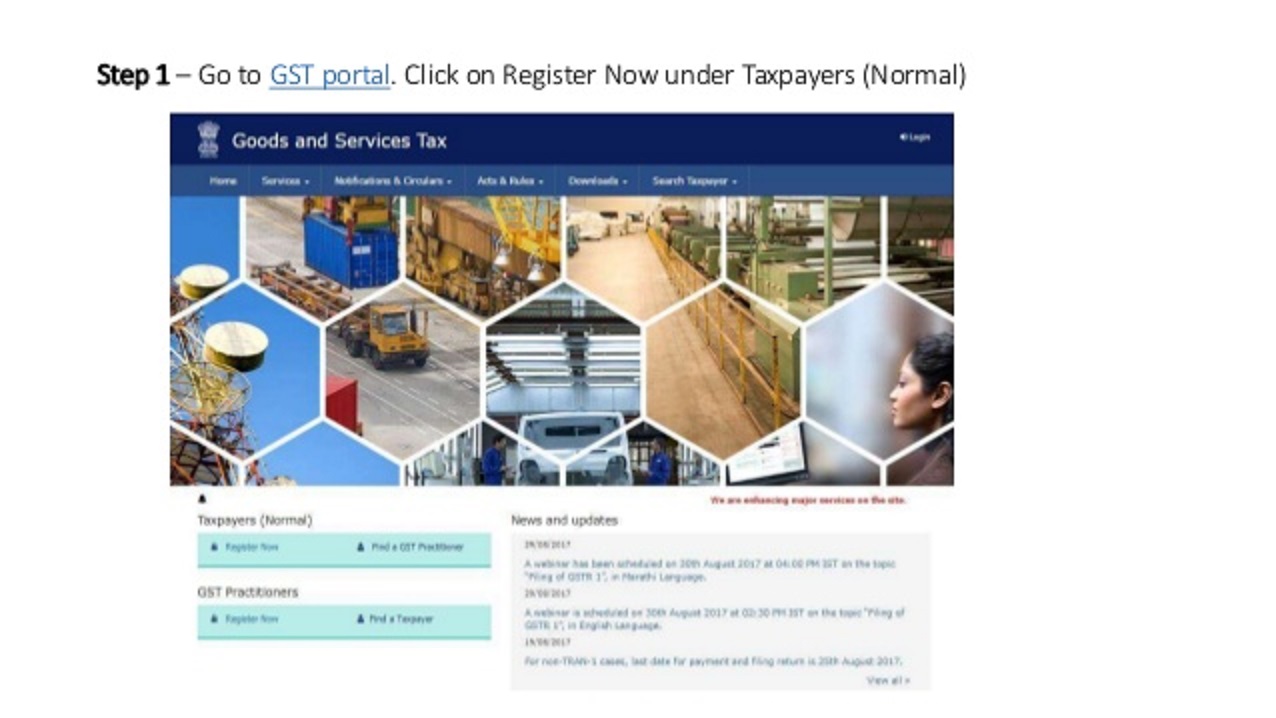

Step 1 – Visit the government GSTportal and Click on Register Now under Taxpayers (Normal) Step 2 – Enter the following details in Part A –Select New Registrationo In... Read More

New Fund Offering by SBI MF – SBI Dividend Yield Fund

New Fund Offering by SBI MF – SBI Dividend Yield Fund  Bharti Airtel’s 5G user-base expands

Bharti Airtel’s 5G user-base expands  GK TODAY -HISTORY AT A GLANCE

GK TODAY -HISTORY AT A GLANCE