Income Tax

Income tax is a tax paid to the central government on personal income. It is the direct tax paid on income by an individual or a company/firm within a given financial year. The Indian Income Tax department is governed by the Central Board for Direct Taxes (CBDT) and is part of the Department of Revenue under the Ministry of Finance , Government of India.

Detailed information on all types of taxation in India can be found here.

The Income Tax Act, 1961 as amended by Finance Act 2010 , under Section 139 makes it obligatory upon any person to file return if the person’s total income or the total income of any other person in respect of which he is assessable under this Act during the previous year exceeded the maximum amount which is not chargeable to income-tax.

Provided that a person referred to, who is not required to furnish a return under this sub-section and residing in such area as may be specified by notification in the Official Gazette, and who during the previous year incurs an expenditure of fifty thousand rupees or more towards consumption of electricity or at any time during the previous year fulfils any one of the following conditions, namely:

- is in occupation of an immovable property exceeding a specified floor area, whether by way of ownership, tenancy or otherwise, as may be specified; or

- is the owner or the lessee of a motor vehicle other than a two-wheeled motor vehicle, whether having any detachable side car having extra wheel attached to such two-wheeled motor vehicle or not; or

- has incurred expenditure for himself or any other person on travel to any foreign country; or

- is the holder of a credit card, not being an “add-on” card, issued by any bank or institution; or

- is a member of a club where entrance fee charged is twenty-five thousand rupees or more.

The tax liability to be computed for AY 2012 -2013 is as per the under:-

(i) In case of individuals (other than women and individuals who are of the age of 60 years or more at any time during the financial year 2011-12) –

Income (In Rs.): Tax Liability (In Rs.)

- Upto Rs.1,80,000 : Nil

- Between Rs.1,80,001 – Rs.5,00,000 : 10%

- Between Rs.5,00,001 – Rs.8,00,000 : 20%

- Above Rs.8,00,000 : 30%

(ii) In case of women (other than women who are of the age of 60 years or more at any time during the financial year 2011-12)-

Income (In Rs.) : Tax Liability (In Rs.)

- Upto Rs.1,90,000 : Nil

- Between Rs.1,90,001 – Rs.5,00,000 : 10%

- Between Rs.5,00,001 – Rs.8,00,000 : 20%

- Above Rs.8,00,000 : 30%

(iii) In case of individuals who are of the age between 60 and 80 years at any time during the financial year 2011-12-

Income (In Rs.) : Tax Liability (In Rs.)

- Upto Rs.2,50,000 : Nil

- Between Rs.2,50,001 – Rs.3,00,000 : 10%

- Between Rs.3,00,001 – Rs.5,00,000 : 20%

- Above Rs.5,00,000 : 30%

(iv) In case of individuals who are of the age of 80 years or more at any time during the financial year 2011-12-

Income (In Rs.) : Tax Liability (In Rs.)

- Upto Rs.5,00,000 : Nil

- Between Rs.5,00,001 – Rs.8,00,000 : 20%

- Above Rs.8,00,000 : 30%

How to link Mobile Number with Aadhaar using OTP

How to link Mobile Number with Aadhaar using OTP  Difference between Aadhaar and Social Security Number (US)

Difference between Aadhaar and Social Security Number (US)  Do you Know GK Today Series,Interesting Facts and figures

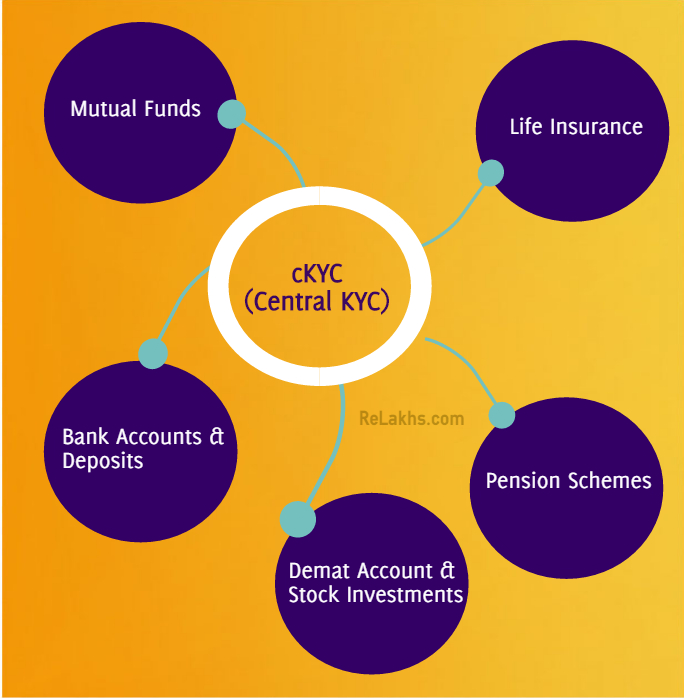

Do you Know GK Today Series,Interesting Facts and figures  The Central KYC Registry or Know your Customer Registry

The Central KYC Registry or Know your Customer Registry  Statue of Unity and Top Tallest Statues in the World

Statue of Unity and Top Tallest Statues in the World  New Fund Offering by SBI MF – SBI Dividend Yield Fund

New Fund Offering by SBI MF – SBI Dividend Yield Fund  Bharti Airtel’s 5G user-base expands

Bharti Airtel’s 5G user-base expands  GK TODAY -HISTORY AT A GLANCE

GK TODAY -HISTORY AT A GLANCE