Common Economic Terms

Floating Debt: Generally, any short-term debt, specifically, the part of the national debt that consists of short-term borrowing.Fringe benefits: Rewards for employment over and above the wager paid. e.g. goods at a discount, subsidized meals, arrangements, etc.

Fiscal Policy: that part of government policy which is concerned with raising revenue through taxation and deciding on the level and pattern of expenditure.

Fixed Costs: Costs which in the short run do not vary with outputs. These costs are borne even if no output is produced.

Asset: Anything of monetary value that is owned by a person. Assets include real property, personal property, and enforceable claims against others (including bank accounts, stocks, mutual funds, and so on)

Base year: In the construction of an index, the year from which the weights assigned to the different components of the index is drawn. It is conventional to set the value of an index in its base year equal to 100. Bear: An investor with a pessimistic market outlook; an investor who expects prices to fall and so sells now in order to buy later at a lower price. A Bear Market is one which is trending downwards or losing value.

Bid price: The highest price an investor is willing to pay for a stock.

Bill of exchange: A written, dated, and signed three-party instrument containing an unconditional order by a drawer that directs a drawee to pay a definite sum of money to a payee on demand or at a specified future date. Also known as a draft. It is the most commonly used financial instrument in international trade.

Bond: A certificate of debt (usually interest-bearing or discounted) that is issued by a government or corporation in order to raise money; the bond issuer is required to pay a fixed sum annually until maturity and then a fixed sum to repay the principal. Bonds guide.

Collateral security: Additional security a borrower supplies to obtain a loan.

Compound interest: Interest paid on the original principal and on interest accrued from time it became due.

Consumer Surplus is the difference between the price a consumer pays and what they were prepared to pay.

Direct tax: A tax that you pay directly, as opposed to indirect taxes, such as tariffs and business taxes. The income tax is a direct tax, as are property taxes. See also Indirect Tax.

Double taxation: Corporate earnings taxed at both the corporate level and again as a stockholder dividend

Exchange rate: The price of one currency stated in terms of another currency, when exchanged.

Inflation is the percentage increase in the prices of goods and services.

Repo rate: This is one of the credit management tools used by the Reserve Bank to regulate liquidity in South Africa (customer spending). The bank borrows money from the Reserve Bank to cover its shortfall. The Reserve Bank only makes a certain amount of money available and this determines the repo rate. If the bank requires more money than what is available, this will increase the repo rate – and vice versa.

Revenue expenditure: This is expenditure on recurring items, including the running of services and financing capital spending that is paid for by borrowing. This is meant for normal running of governments’ maintenance expenditures, interest payments, subsidies and transfers etc. It is current expenditure which does not result in the creation of assets. Grants given to State governments or other parties are also treated as revenue expenditure even if some of the grants may be meant for creating assets.

Subsidy : Financial assistance (often from the government) to a specific group of producers or consumers.

India’s first Fintech Company listed in the National Stock Exchange and Bombay Stock exchange

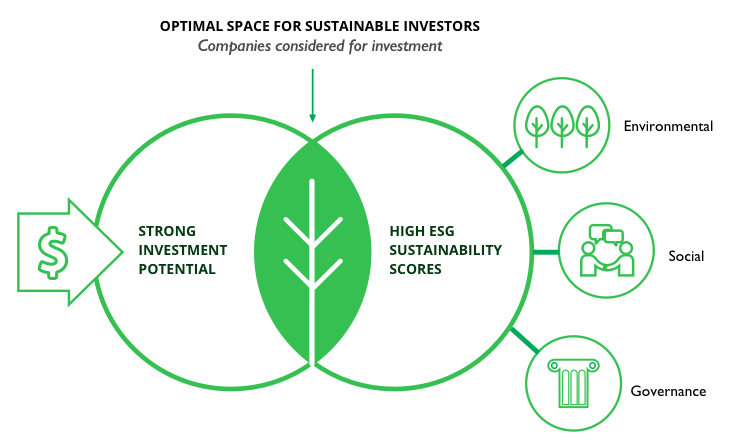

India’s first Fintech Company listed in the National Stock Exchange and Bombay Stock exchange  The Impact Of Air Pollution And ESG Investing.

The Impact Of Air Pollution And ESG Investing.  Difference between Aadhaar and Social Security Number (US)

Difference between Aadhaar and Social Security Number (US)  Your Cost Of Investing In Mutual Funds To Come Down

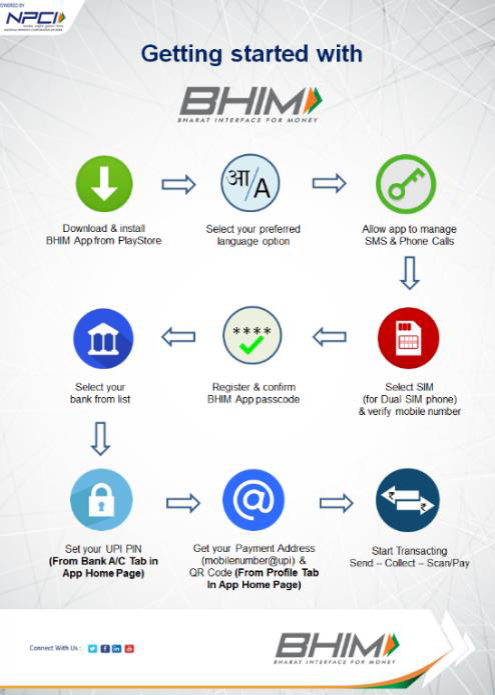

Your Cost Of Investing In Mutual Funds To Come Down  NACH- NPCI has implemented National Automated Clearing House

NACH- NPCI has implemented National Automated Clearing House  New Fund Offering by SBI MF – SBI Dividend Yield Fund

New Fund Offering by SBI MF – SBI Dividend Yield Fund  Bharti Airtel’s 5G user-base expands

Bharti Airtel’s 5G user-base expands  GK TODAY -HISTORY AT A GLANCE

GK TODAY -HISTORY AT A GLANCE

A blog for IBPS, SBI and RBI exam aspirants…

The home of bank job aspirants, where the banking related news is updated everyday. Visit this blog everyday to improve your awareness in banking and finance. Regular updation of general knowledge, current affairs, banking and finance terms will be here.