What is UPI and How to perform a UPI Transaction

Unified Payments Interface (UPI) is a payment system launched by National Payments Corporation of India and regulated by the Reserve Bank of India which facilitates the instant fund transfer between two bank accounts on the mobile platform.

UPI is built over Immediate Payment Service (IMPS) for transferring funds using Virtual Payment Address (a unique ID provided by the bank), Account Number with IFS Code, Mobile Number with MMID (Mobile Money Identifier), Aadhaar Number, or a one-time use Virtual ID. An MPIN (Mobile banking Personal Identification number) is required to confirm each payment.

Performing a UPI (Unified Payments Interface) Transaction

Customer enters his Virtual Payment Address (VPA) and proceeds to pay.

Note: Virtual payment address (VPA) is a user-generated unique identifier for each bank account. All payment addresses are in the format abc @bank, where abc can be chosen by the customer.

A payment collection request for the transaction amount is sent to the customer on this VPA.

Customer will receive a mobile notification in their UPI app prompting him to authenticate the transaction with his 4 digit MPIN (Mobile Banking password)

Customer accepts the transaction and the payment is complete.

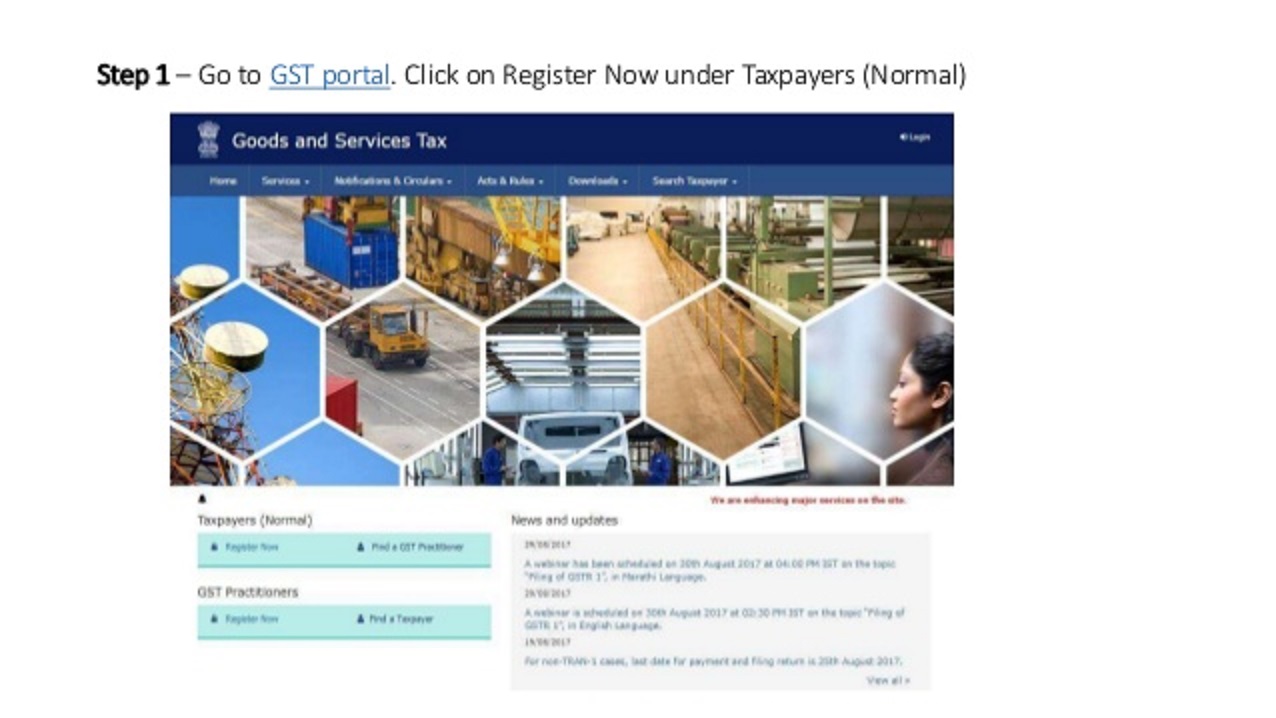

Steps for obtaining GST

Steps for obtaining GST  UPSTOX customers enjoy Flipkart vouchers up to Rs.500

UPSTOX customers enjoy Flipkart vouchers up to Rs.500  Upstox Launches the Free Demat Fest

Upstox Launches the Free Demat Fest  New Fund Offering by SBI MF – SBI Dividend Yield Fund

New Fund Offering by SBI MF – SBI Dividend Yield Fund  Bharti Airtel’s 5G user-base expands

Bharti Airtel’s 5G user-base expands  GK TODAY -HISTORY AT A GLANCE

GK TODAY -HISTORY AT A GLANCE