Mutual Funds and Online trading accounts.Frequently Asked Questions and Answers

Definition of ‘Mutual Fund’

Definition: A mutual fund is a professionally-managed investment scheme, usually run by an asset management company that brings together a group of people and invests their money in stocks, bonds and other securities.

Description: As an investor, you can buy mutual fund ‘units’, which basically represent your share of holdings in a particular scheme. These units can be purchased or redeemed as needed at the fund’s current net asset value (NAV). These NAVs keep fluctuating, according to the fund’s holdings. So, each investor participates proportionally in the gain or loss of the fund.

All the mutual funds are registered with SEBI. They function within the provisions of strict regulation created to protect the interests of the investor.

The biggest advantage of investing through a mutual fund is that it gives small investors access to professionally-managed, diversified portfolios of equities, bonds and other securities, which would be quite difficult to create with a small amount of capital.

Yet to open a Account?

Open a online Trading Account now!

What is an Equity Fund?

An Equity Fund is a Mutual Fund Scheme that invests predominantly in shares/stocks of companies. They are also known as Growth Funds.

What is a Direct Plan / Regular Plan?

What is a Direct Plan / Regular Plan?

All Mutual Fund Schemes offer two plans- Direct and Regular. In a Direct Plan, an investor has to invest directly with the AMC, with no distributor to facilitate the transaction. In a Regular Plan, the investor invests through an intermediary such as distributor, broker or banker who is paid a distribution fee by the AMC, which is charged to the plan.

Long term. Short term. Your choice.

Long term. Short term. Your choice.

Are Mutual Funds ideal for short term or long term?

“Mutual Funds could be a good saving tool for short term.”

“You must be patient with your Mutual Fund investments. It takes time to deliver results.”

People regularly come across both the above statements, which are clearly contradictory.

What is the minimum and maximum tenure that I can invest in Mutual Funds?

What is the minimum and maximum tenure that I can invest in Mutual Funds?

The minimum tenure for investment in Mutual Funds is a day and the maximum tenure is ‘perpetual’.

Yet to open a Account?

Open a online Trading Account now!

New Fund Offering by SBI MF – SBI Dividend Yield Fund

New Fund Offering by SBI MF – SBI Dividend Yield Fund  Bharti Airtel’s 5G user-base expands

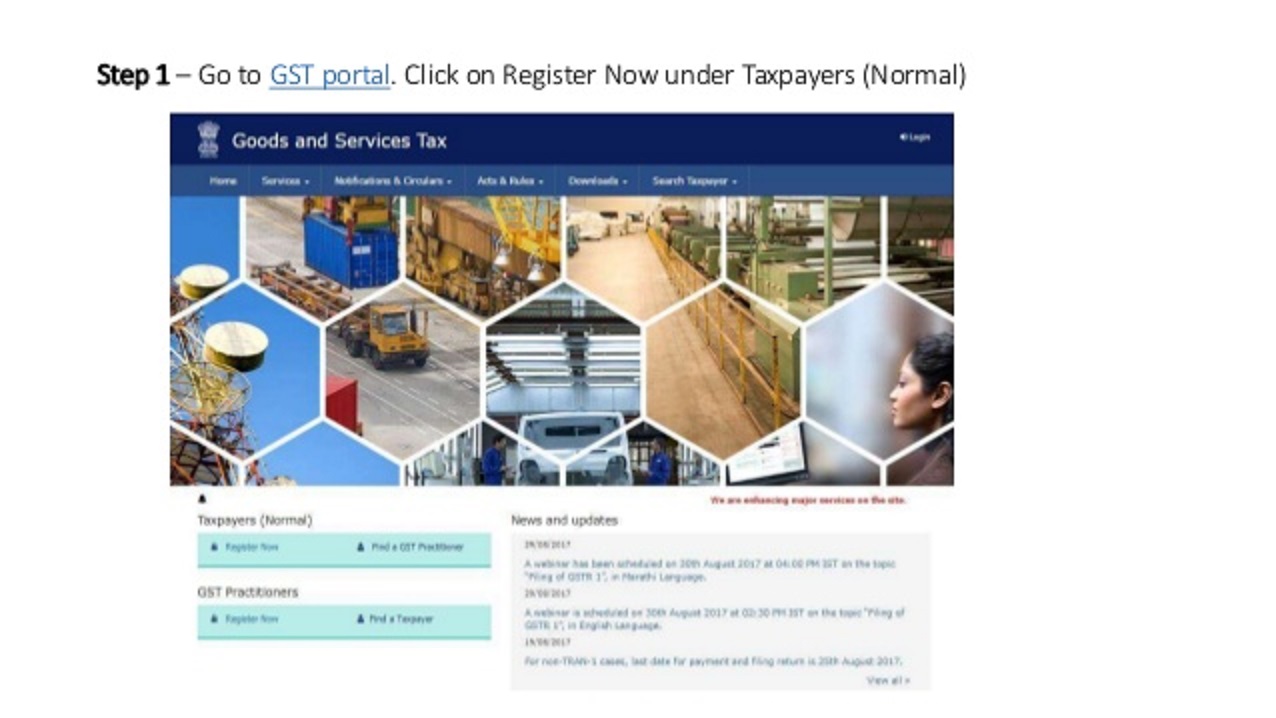

Bharti Airtel’s 5G user-base expands  Steps for obtaining GST

Steps for obtaining GST  FREE Demat + Trading account opening

FREE Demat + Trading account opening  GK TODAY -HISTORY AT A GLANCE

GK TODAY -HISTORY AT A GLANCE